Automate Financial Consolidation and Simplify Business Processes with One Intuitive Solution

- End to End Financial Consolidation

- Ready-Made Templates

- Simplified IFRS and GAAP Compliance

"*" indicates required fields

Speed and Accuracy: Is Your Financial Software Slowing You Down?

Quickly Outgrowing Your Existing Solution

Your current consolidation software is inflexible and inadequate for your growing business. You now need comprehensive automation to mitigate the increased complexity associated with having more subsidiaries and legal entities.

Wasting Time on Error-Prone Manual Processes

With financial data saved in multiple spreadsheets across various devices being shared back-and-forth over email, errors are going to happen. To meet monthly and quarterly requirements efficiently, you need a more streamlined, reliable solution.

Compliance is Increasingly Hard to Manage

Your existing solution is no longer able to support your team in managing fast-changing regional and international accounting standards. Ensuring compliance effectively requires a system with the latest IFRS and GAAP accounting standards built in.

The Accessible Tool for Close and Consolidation

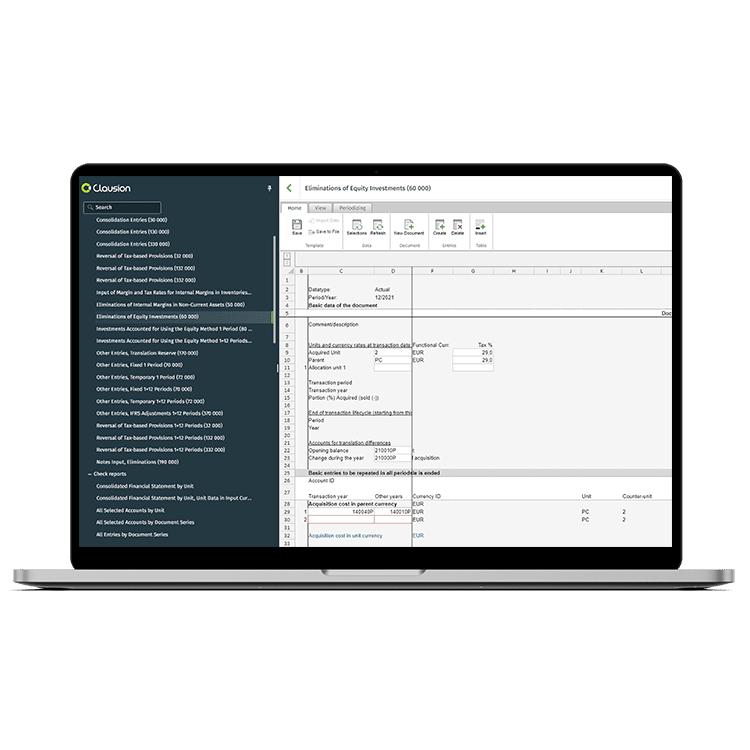

Clausion Consolidation is an intuitive, Cloud-based financial consolidation solution that enables you to streamline day-to-day business processes.

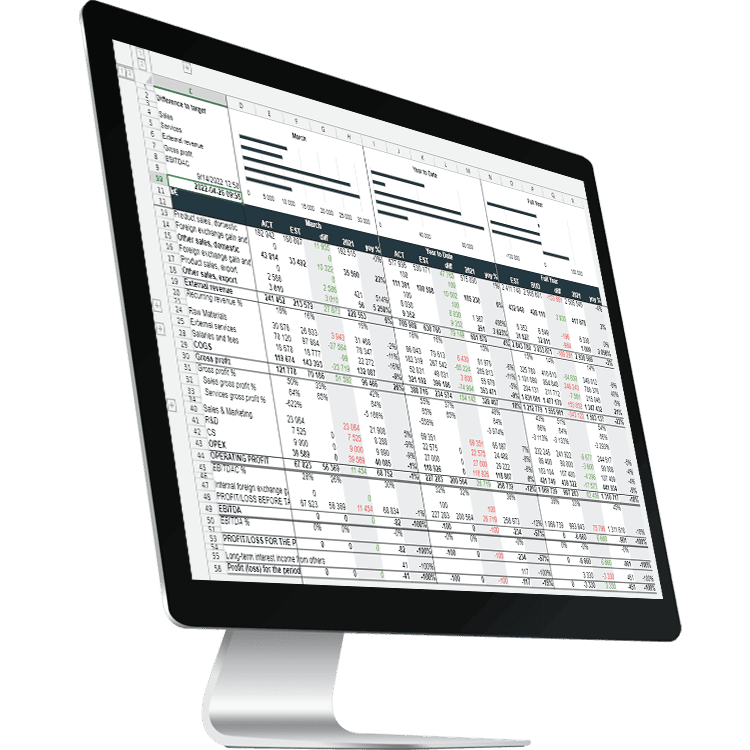

Expand your financial consolidation to include an all-in-one system and create effective planning reports, including targets, budgeting, and forecasts.

Conduct comprehensive operational planning and analysis for investments and personnel – all in one purpose-built solution.

Save Time with Tried-and-tested Automated Processes

Switch tedious, error-prone manual data processing for automated best-practice templates that will drive your team’s productivity.

Reimagine close and consolidation with ready-made reporting software for multi-entity IFRS and local GAAP consolidation.

With clear, ready-to-go tools designed to accelerate productivity and scale alongside your organization, your team will start benefiting right away.

Drive Reliability and Accuracy with One Source of Data

Automate financial consolidation for faster decision-making with trusted data. Embrace data visibility and intelligence across your organization to deliver truly data-driven strategies.

Move forward with Clausion Consolidation – the flexible solution enabling teams to work at pace to support their growing organizations.

Business Transformation is a Click Away. Get Started with a Tailored Estimate!